Idea In Brief

Coordination

We need to coordinate infrastructure planning and industry development at a national scale. Connecting demand and supply requires careful planning to create viable projects and investment opportunities.

Investment

We need to unlock major capital investment. While global interest in Australian net zero opportunities is growing, more can be done to reduce risk and accelerate capital investments across the country.

Risk

We need to de-risk infrastructure delivery. Many infrastructure projects underpinning the net zero transition face planning and delivery challenges that have resulted in unanticipated costs.

The Pathways to Net Zero series offers context, insights and key questions on different aspects of Australia’s transition to net zero. It builds on the groundbreaking research of Net Zero Australia. You can read earlier editions in the series on our website.

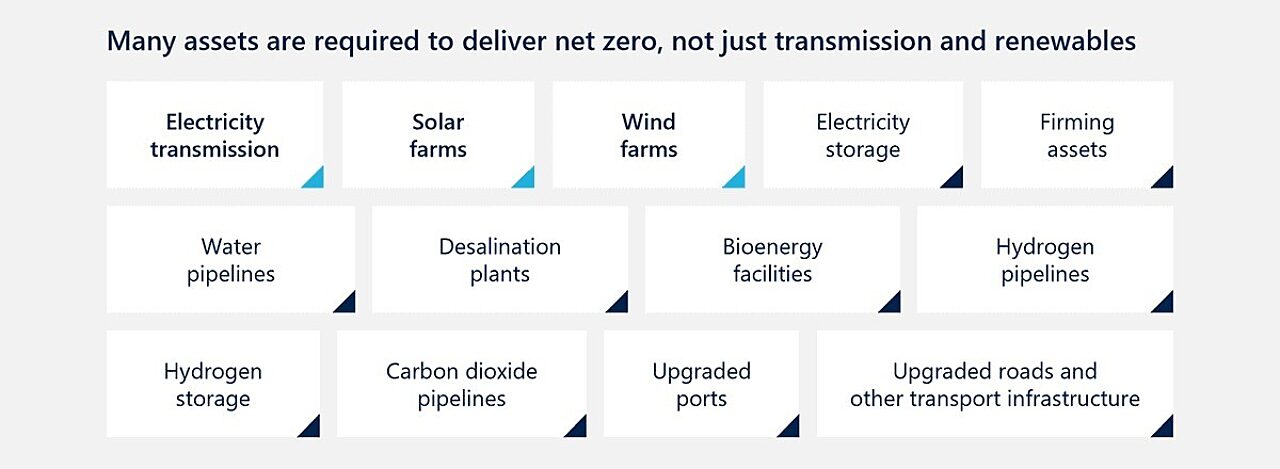

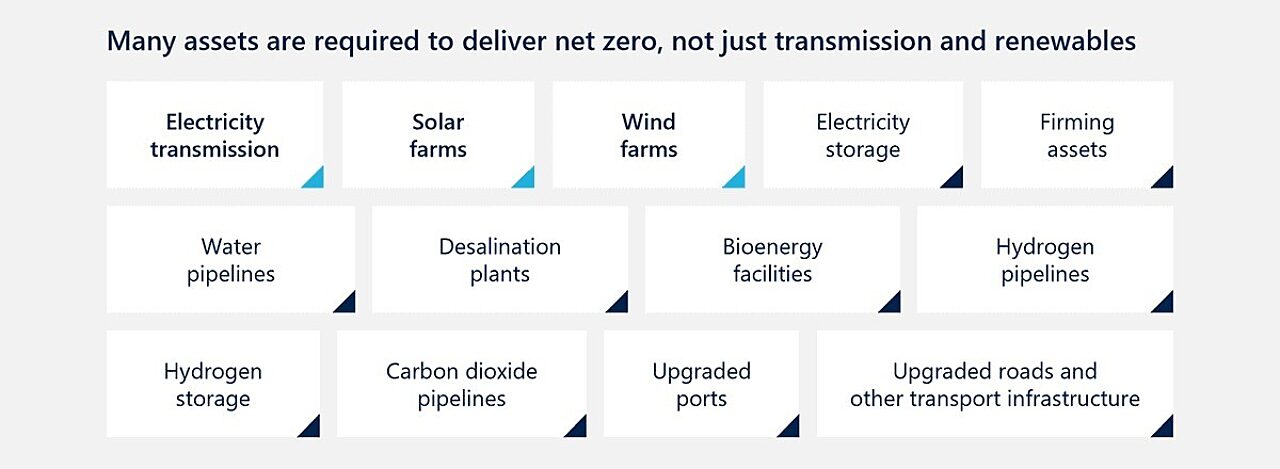

Australia’s transition to net zero will be among the fastest, most significant economic transformations in history. Major enabling infrastructure is required nationwide to connect renewable energy loads, to modernise supply chains and to transport new commodities such as hydrogen and carbon dioxide.

From transmission lines to solar and wind farms, as well as other assets and upgrades, this vital enabling infrastructure is not being rolled out fast enough.

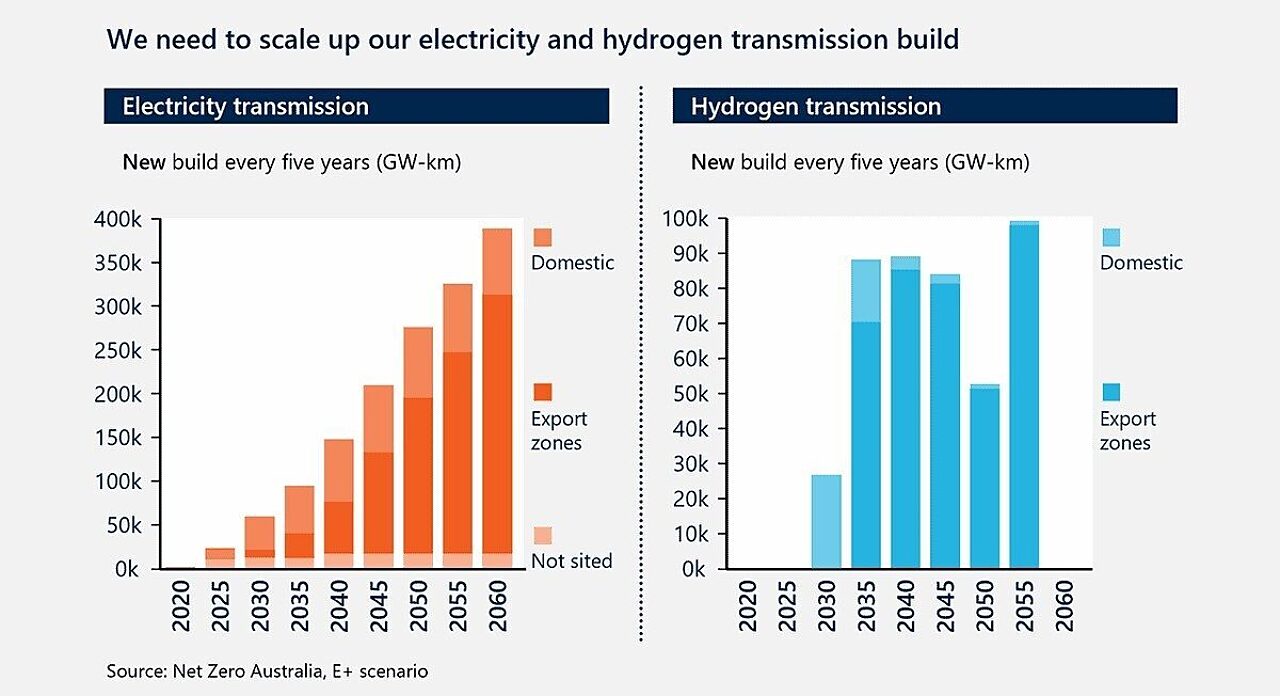

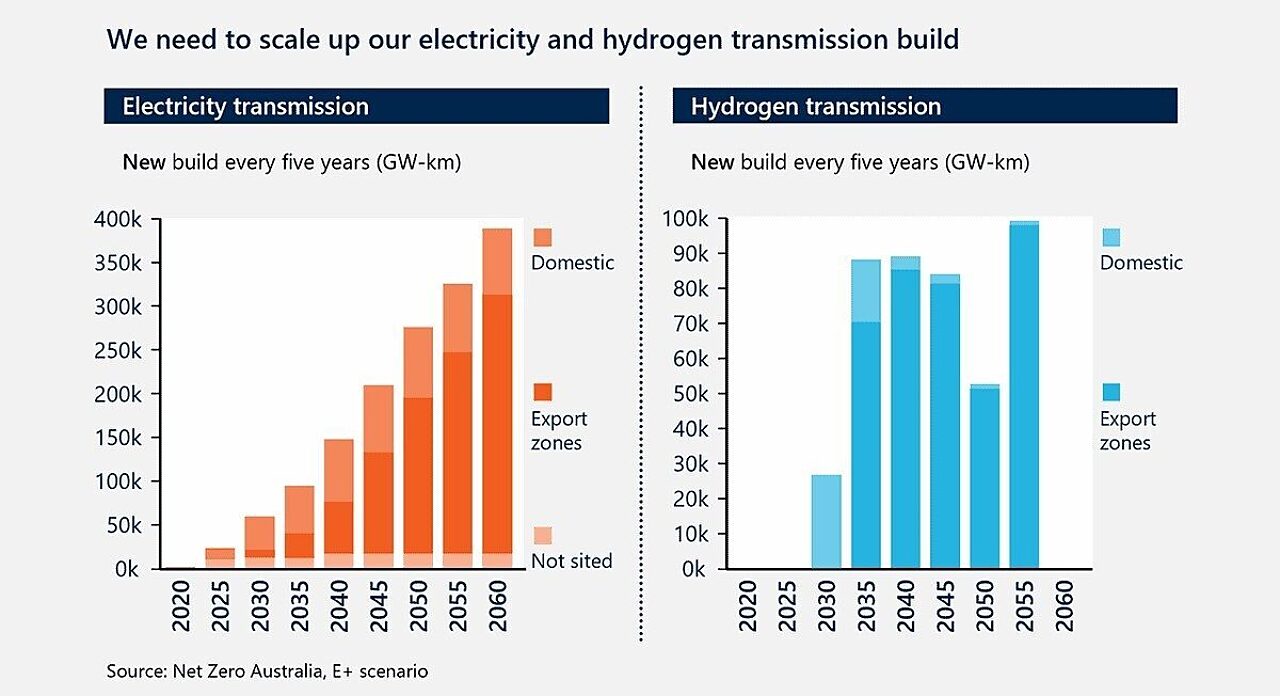

Our work on the Net Zero Australia Mobilisation Report used detailed scenarios to model many of these enabling infrastructure requirements, including a massive scale-up of Australia’s electricity transmission and hydrogen transmission capacity.

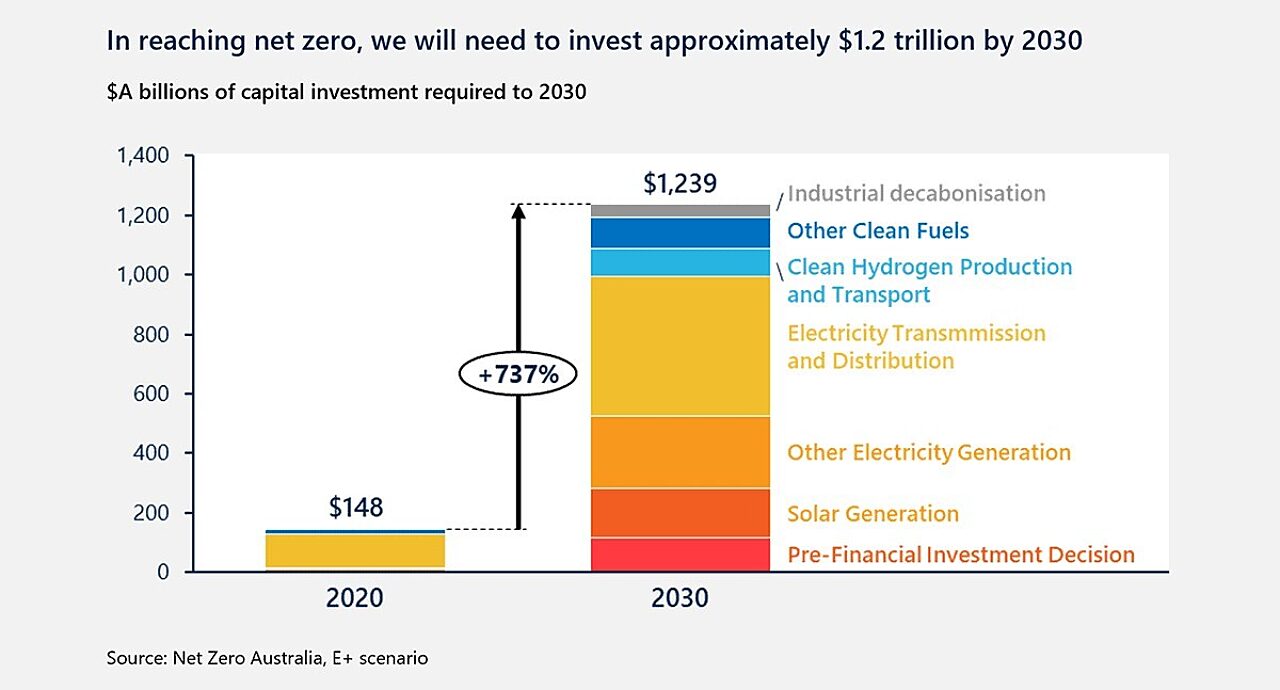

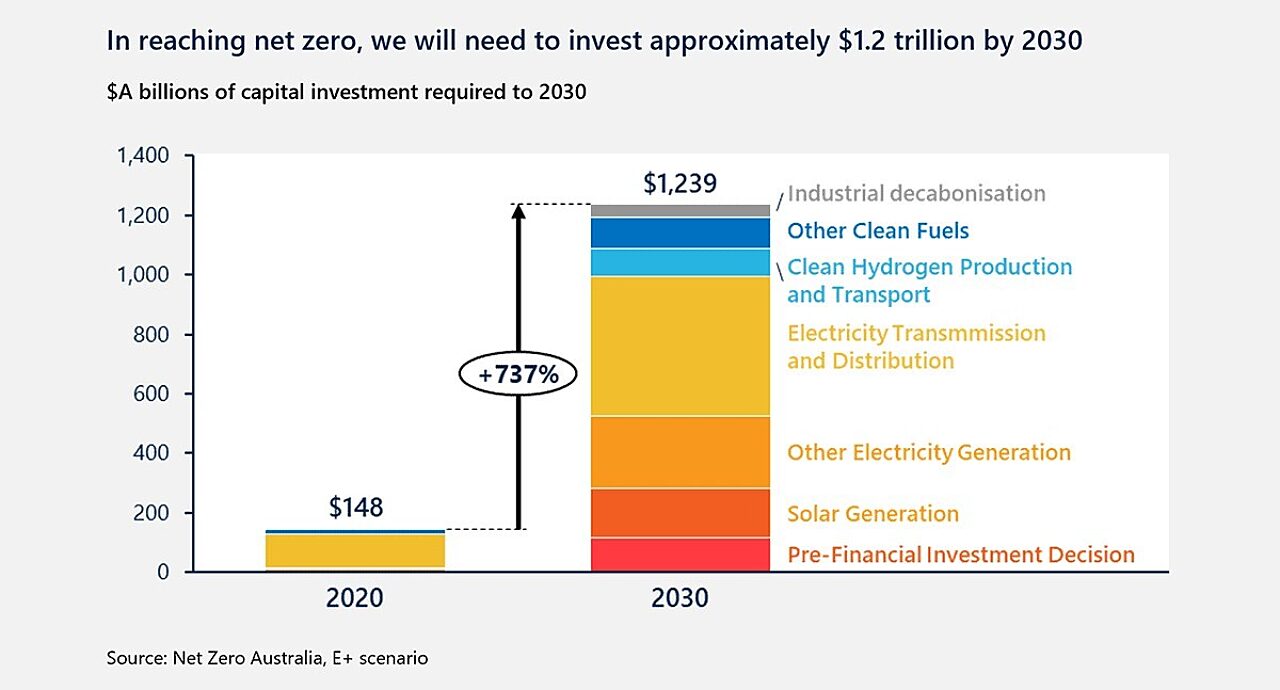

Overall, the study estimates that Australia must attract and invest between $7 trillion and $9 trillion over the next 35 years to decarbonise our domestic economy and energy exports. This will require unprecedented investment in enabling and/or shared infrastructure between now and 2030.

What comes next?

Essentially, Australia must overcome three challenges to accelerate shared infrastructure deployment and meet the pace and scale required by net zero targets:

1. We need to coordinate infrastructure planning and industry development at a national scale.

Common infrastructure connects electricity supply and demand. For example, if using grid-connected power, distribution and transmission lines carry electrons from the electricity generation point to the light bulb in your home. Future energy sources such as green hydrogen will require new common infrastructure in the form of water pipelines to carry water from desalination plants to a hydrogen electrolyser.

Connecting demand and supply requires careful planning to create viable projects and investment opportunities. Potential enabling actions include:

- Establish market foundations and settings early. For new and transforming markets, governments should seek to build foundations that enable shared infrastructure investment. It is also vital to look for ways to facilitate deals across industry sectors and international borders to stimulate demand. For example, hydrogen offtake agreements can be struck with overseas trading partners to accelerate infrastructure investment in hydrogen and capture early-mover advantages.

- Leverage scale and using group purchasing to increase certainty. Establishing minimum levels of supply and/or demand often inhibit the deployment of shared infrastructure. There is an opportunity for the private and public sectors to coordinate and consolidate supply and demand, providing scale and certainty. For example, the public sector could take a lead role in emissions reduction by decarbonising its operations. Many state governments have begun to purchase clean electricity through offtake agreements. This could be extended to other clean fuels and zero emissions technologies.

- Coordinate industry decarbonisation and supply chain planning. Industry has a significant transition to switch fuels, commodities and various processes. Government and the private sector can work together to establish precincts and hubs (such as hydrogen for heavy vehicles), staging feedstock switchovers to renewable gases, and designing frameworks to address market gaps, including new regulations, standards and incentives for net-zero buildings. This will provide the certainty that industry needs to trigger supply- and demand-side investments as well as enabling infrastructure investments.

2. We need to unlock major capital investment.

While global interest in Australian net zero opportunities is growing, more can be done to reduce risk and accelerate capital investments across the country. The following actions can help bridge the gap:

- Scale incentives and supports to meet the size of the decarbonisation challenge. Governments have made progress through pilot programs, research and development, funding, and regulation – just not yet at the necessary scale or breadth. A step-change is needed, investing billions of dollars to unlock trillions to support a full transition.

- Consider a broad range of delivery models. The scale, pace and complexity of the net zero infrastructure build warrants consideration of new construction delivery models. Innovative hybrid financing structures, public-private partnerships and government-ownership models may each have a role to play in securing project funds, resources and supply chain partners, while achieving value for money.

- Consider cost recovery and equity implications. There is an ongoing debate about who pays for the net zero transition. Without a tax on carbon, policymakers should thoughtfully consider the merit and role of user charges, taxpayer funds and other funding sources, incentives and programs.

3. We need to de-risk infrastructure delivery.

Many infrastructure projects underpinning the net zero transition face planning and delivery challenges that have resulted in unanticipated costs. These include negotiations with landholders, delays to planning approvals and uncertainty over key design elements.

More is needed to de-risk project delivery to achieve the required pace and reduce project costs. This includes optimising planning approaches, accelerating approvals, and improving engagement with communities and stakeholders.

The big questions for transition leaders

For government

- What is the right mix of funding and cost-recovery models to incentivise infrastructure investments at the required scale and pace?

- How can governments transition their own operations to net zero, creating demand for zero-carbon fuels and short-term utilisation of common infrastructure?

- How can governments coordinate local clean energy producers and international businesses seeking to pursue offtake agreements?

- How can governments optimise joint planning and funding for major infrastructure across Australian states and territories?

For business, industry and investors

- How can the decarbonisation of supply chains be coordinated to reduce costs and improve national competitiveness, and how should governments support this effort?

- How can the private sector better collaborate with governments to co-design support mechanisms, jointly plan common infrastructure and de-risk delivery?

- How can investors, government and industry co-design financing models and support mechanisms to accelerate capital deployment and reduce project risks?

- What innovative models will help to plan, finance and deliver a consistent stream of mega-scale infrastructure projects?

Get in touch to discuss how these issues impact your organisation.

Connect with Phillip Vrettakis and Tom Strawhorn on LinkedIn.