Idea In Brief

Climate risks in Australia are significant and varied

The National Climate Risk Assessment identified 63 nationally significant climate risks, with 11 demanding urgent action, highlighting the need for faster and smarter adaptation.

Investing in local and First Nations knowledge is crucial

By funding local communities and First Nations-led initiatives, we can create tailored, long-term solutions that leverage deep, cultural knowledge and community ownership.

Innovative financial models can enhance resilience

Rewiring how resilience is financed and trialing new insurance models can help households and small businesses access the resources they need to adapt and protect themselves.

Australia has just released its first National Climate Risk Assessment and National Adaptation Plan. The findings are sobering. The Assessment identified 63 nationally significant climate risks – from water security to insurance affordability – across eight intersecting systems and found 11 that demand urgent action. The message is clear: without faster, smarter adaptation, the costs will cascade across communities, industries and governments.

For many, this has been read as a doomsday omen. More fires, more floods, more communities under stress.

But I see something different. I see a call to action. A roadmap telling us, with unusual clarity, where the biggest risks lie, and where the biggest opportunities to prepare and adapt will come from.

So, let’s run a thought experiment. If someone gave me $1 billion to spend on building resilience in Australia, how would I invest it for maximum impact?

To run this thought experiment, I drew on Nous Group’s deep experience working across all eight intersecting systems highlighted in the national risk assessment, including with Aboriginal and Torres Strait Islander peoples. This includes countless projects with state and Australian government agencies, private sector organisations and their industry bodies, not-for-profits, and philanthropic foundations.

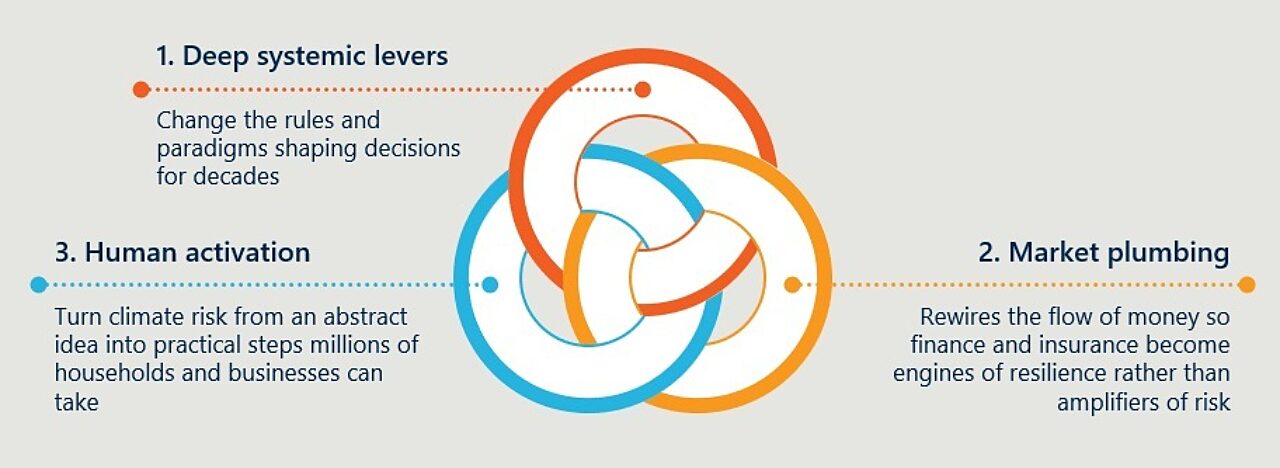

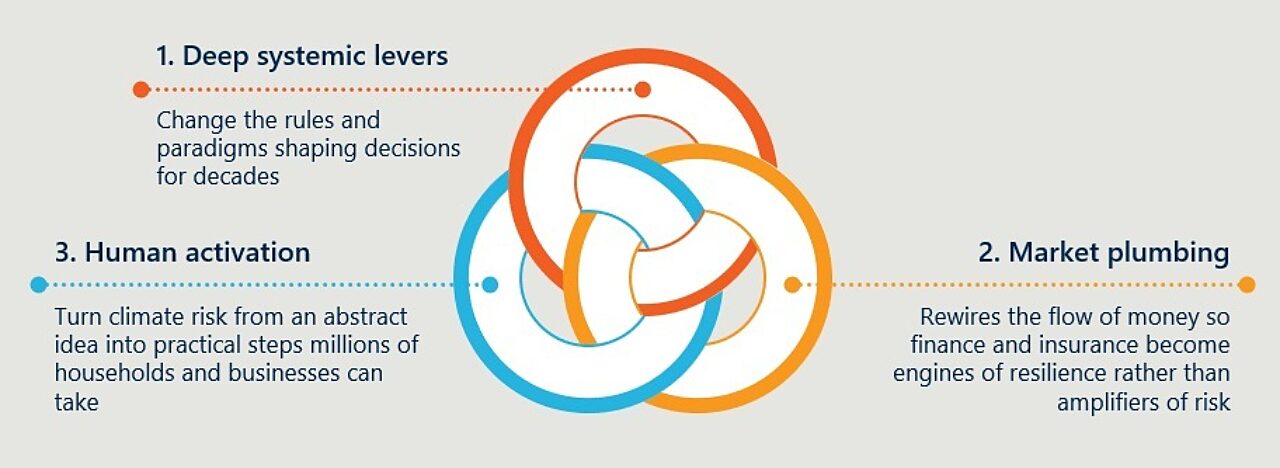

Three principles shape up a three-gear resilience machine

I used three lenses to guide my choices:

- Target the deepest system levers. Some interventions nibble at the edges. Others change the rules of the game. I looked for investments that reshape how decisions get made, how money flows, and who holds power.

- Seed innovations that speed up transitions. Big shifts don’t happen overnight. They start in small niches, get proven, and then break into the mainstream. The right investments don’t just fund projects, but also seed the experiments that can grow into new norms.

- Fill gaps that others can’t or won’t fill. There’s no point in duplicating what governments or markets are already funding. If you gave me $1 billion, I would use it to fill the gaps: taking risks others won’t, backing ideas that are ahead of their time, and stitching together solutions that cut across silos.

Applied together, these principles point to a portfolio that works like a three-gear resilience machine:

Like any machine, all three gears need to turn together. And that’s what the six investments below are designed to do.

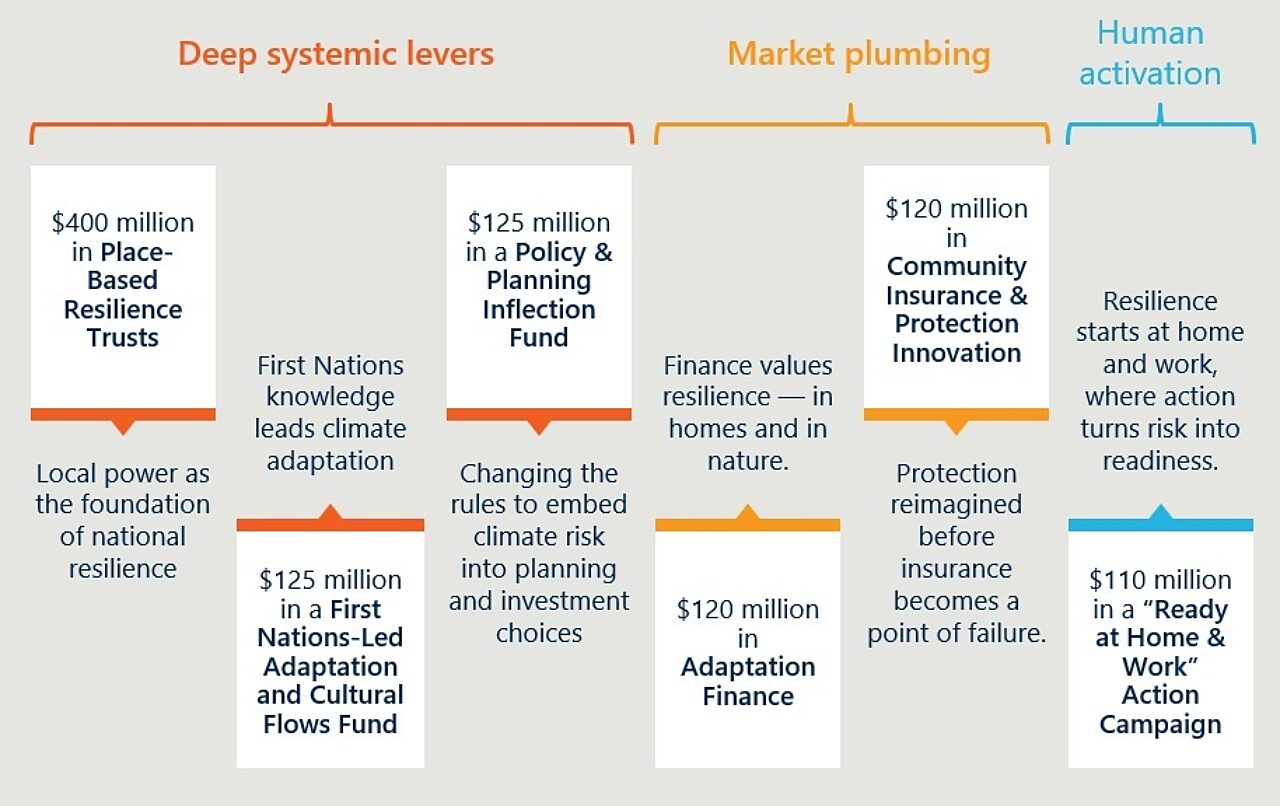

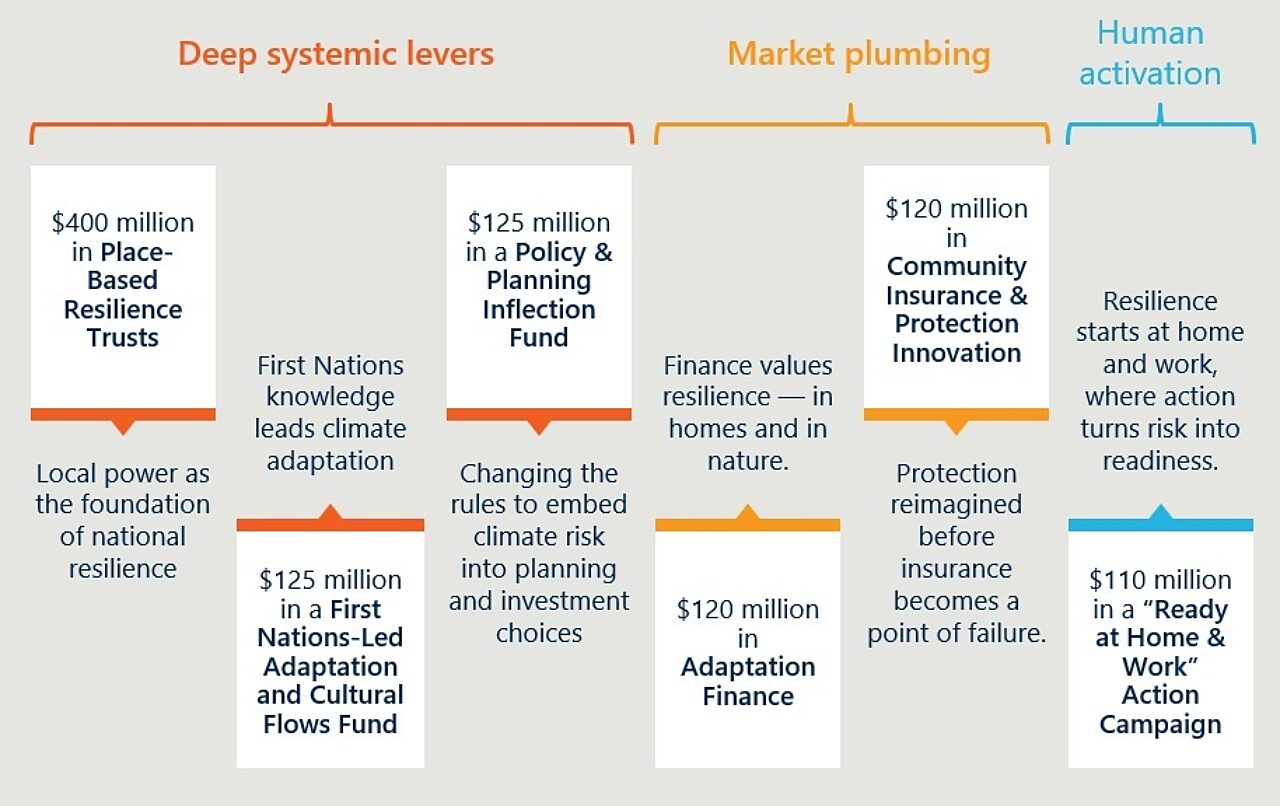

Deep systemic levers: Changing the rules and paradigms

Investment 1: $400 million in Place-Based Resilience Trusts

The climate risks facing Australia aren’t evenly spread. Some towns are already staring down “Day Zero” water shortages, others face repeat floods, and many are losing the volunteers and services they rely on. National strategies can’t possibly capture these differences.

That’s why I’d invest in local power as the foundation of national resilience – 25 communities funded with $15 million each, backed by a $25 million national “translation backbone.” These trusts would give local leaders long-term, flexible resources to plan, trial, and scale what works for them, while the backbone captures lessons and helps other places adapt faster.

This is the deepest system lever of all: shifting who gets to decide, and how. Resilience sticks when it’s community-owned, not imposed from outside. And by funding 25 places properly, we prove the model, attract government and private co-investment, and create templates that can be rolled out across the country.

Investment 2: $125 million in a First Nations-Led Adaptation and Cultural Flows Fund

Australia’s First Nations peoples have managed Country for tens of thousands of years. Their knowledge of fire, water, biodiversity and community resilience is unrivalled – yet too often overlooked or resourced only through short-term projects. That’s a wasted opportunity at a time when cultural stewardship could be one of our strongest defences against climate risk.

That’s why I’d invest in First Nations knowledge as a cornerstone of adaptation – $125 million in a dedicated fund that provides patient, flexible capital for communities to design and deliver their own priorities. These could include food and water security, ranger programs, cultural burning, and resilience hubs that embed cultural knowledge alongside modern risk management.

This is about shifting paradigms: who leads, whose knowledge counts, and what adaptation looks like when First Nations knowledge leads alongside western science, not behind it. It’s also about continuity – giving communities the security to plan for decades, not just grant cycles. If we’re serious about resilience, First Nations leadership has to move from the margins to the centre.

Investment 3: $125 million in a Policy & Planning Inflection Fund

One of the strongest signals from the National Climate Risk Assessment is that climate risk isn’t just about hazards, but about decisions. Where we build homes. How we plan our towns and cities. Whether we allow people to rebuild in flood zones again and again. Right now, those decisions are often made without fully accounting for climate risk, locking in exposure for decades to come.

That’s why I’d invest in changing the rules of the game – $125 million to back independent policy labs, model new, fit-for-purpose planning codes, and strategic advocacy. It would give councils, planners and communities the tools and support to embed climate risk into planning and investment choices.

This is one of the highest leverage points we have: shifting the rules that shape decisions every day. With the right policies, we can prevent billions in future losses before they occur. Insurance markets are already signaling risk through rising premiums and coverage retreat – but that’s a blunt instrument that leaves households, small businesses and ultimately government carrying the cost. An investment like this can push for structured policy responses that get ahead of the market, not behind it. And crucially, it can do what governments often won’t: challenge entrenched positions and push for rules that protect people and places for the long term.

Market plumbing: Rewiring the flow of money

Investment 4: $120 million in Adaptation Finance

One of the clearest findings from the National Climate Risk Assessment is that the money isn’t flowing where it needs to. Households and small businesses face rising risks but can’t access affordable finance to retrofit homes or invest in resilience upgrades. At the same time, wetlands, mangroves and green corridors are still treated as conservation projects rather than as core infrastructure for climate resilience. The current system punishes those on the frontline of climate risk and undervalues the role of nature.

That’s why I’d invest in rewiring how resilience is financed – $120 million to prove new models that unlock private capital at scale. That means designing standard contracts for resilience-linked mortgages and retrofit loans, as well as offering first-loss guarantees that give lenders the confidence to back these products. And crucially, it means demonstrating how finance can back nature-based adaptation through Australia’s emerging Nature Repair Market – helping early projects reach registration, attract buyers, and prove liquidity.

This is a leverage point because it changes the rules of money. Instead of finance amplifying risk and inequality, it becomes a tool for resilience – for households and for nature. Targeted capital can help establish credibility, prove what works, and crowd in new investors.

Investment 5: $120 million in Community Insurance & Protection Innovation

Insurance is meant to be a safety net. But across Australia, that net is fraying. Premiums in high-risk areas are skyrocketing, coverage is being withdrawn altogether, and many households and small businesses are being left unprotected. This is a market signal, but it’s also a social risk: when people can’t insure their homes or livelihoods, whole communities become more vulnerable and less able to recover.

That’s why I’d invest in reimagining how protection works – $120 million to trial new community-level and innovative models. This could include mutual insurance schemes where risk is pooled locally, parametric covers that pay out instantly when an event is triggered, or pilots that reward households with lower premiums when they take steps to reduce risk.

The leverage here is in proving what’s possible. Once new models are demonstrated, insurers, lenders and governments can scale them. Without this kind of investment, the insurance market will keep retreating, leaving people stranded. With it, we can turn protection from a point of failure into a foundation for resilience.

Human activation: Turning awareness into action

Investment 6: $110 million in a “Ready at Home & Work” Action Campaign

When extreme weather hits, resilience often comes down to what happens at the level of homes, families, and small businesses. Yet most people don’t know where to start nor do they fully understand the risks they face. The National Climate Risk Assessment makes it clear that compounding risks – heat, fire, flood, supply chain disruption – require collective action. But right now, individuals are largely left to navigate it on their own.

That’s why I’d invest in turning awareness into action – $110 million for a national campaign that gives households and businesses the tools, incentives and confidence to prepare. This could include clear “top ten actions” checklists, partnerships with banks, insurers and retailers to embed hazard risk information and prompts into everyday transactions, and micro-grants or matched employer contributions to make upgrades affordable.

The leverage here is scale. For relatively modest investment, millions of people can be reached and mobilised. And when households and SMEs act, it doesn’t just reduce their own risk – it lightens the load on emergency services, stabilises local economies, and makes communities more resilient together.

A blueprint for resilience and adaptation

Australia’s first National Climate Risk Assessment doesn’t have to be read as a doomsday prophecy. It can be a blueprint for bold action. My $1 billion thought experiment is one version of what that action could look like: a portfolio of investments that shifts the rules, rewires the money, and mobilises people to act.

A call to action we can’t ignore

But the real point isn’t what I would do with $1 billion. It’s what all of us – governments, businesses, industry bodies, philanthropists, and communities – will choose to do with the resources we already have.

The risks are rising fast, but so are the opportunities to build a safer, more resilient Australia. The only question is whether we act now or keep waiting until the costs are forced on us.

Here’s my challenge: what levers will you start to pull today?

Get in touch to discuss how your organisation can contribute to Australia's climate resilience.

Connect with Carlos Blanco on LinkedIn.